The Cash Discount Program works by giving a discount to all customers who choose to pay with cash (or via ACH) instead of a credit card. Customers who choose to pay with a credit card will pay a non-cash adjustment to the regular price of goods at the point of sale. This allows the business owner to get the full payment from the customer and not incur any credit card processing fees.

Reducing or Eliminating Your Credit Card Processing Fees

How Cash Discounting Works

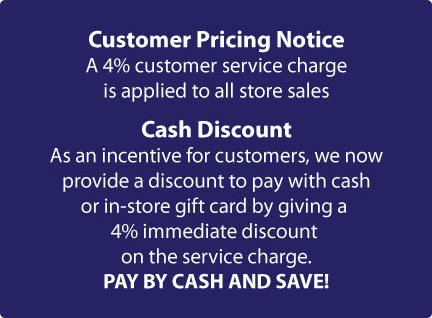

Cash Discount Compliant Verbage

Online ACH Discounting

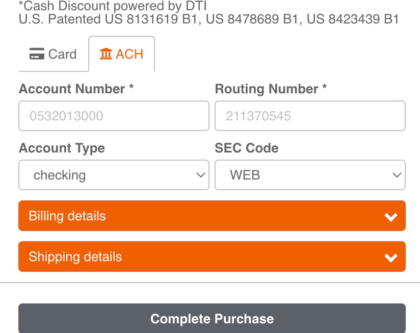

The Cash Discount Program in an Online Setting allows your customers to pay through ACH or E-check instead of a credit card. Customers who choose to pay with ACH will pay a non-cash adjustment to the regular price of goods at the point of sale.

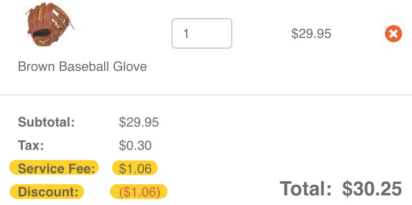

ACH Discounting Example

This Cash Discount Checkout Example of how your customers will be given the “Option to Pay” via ACH instead of a credit card. ACH Fees cost business owners as little as $0.10 per transaction, which is much cheaper to accept as payment when comparing the cost to processing credit cards.

Key Benefits of Cash Discounting

How Our Surcharge Program Works

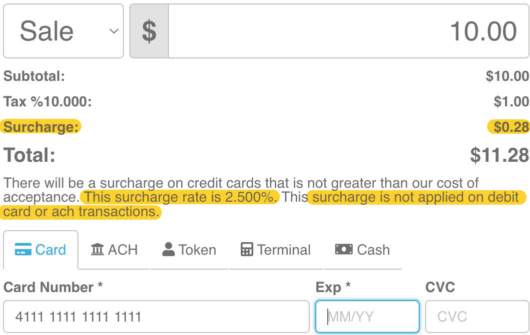

At the time of each purchase, the surcharge program will inform each paying customer of the surcharge fee amount. It will give each customer the option to pay with a Debit Card to avoid paying a Surcharge Fee. Debit Card Fees only are the only rates a business would incur in this program. Debit Card Rates are approximately only 1% per transaction. This program also works with Recurring Billing Type Businesses.

This Surcharge Program is currently available in 48 States. If a Customer lives in Colarado or California, then our software will not impose a surcharge fee on those customers.

Key Benefits of Surcharging Your Customers

Main Benefits of These Programs

Frequently Asked Questions On These Programs

Most of the companies are not complaint because they list the cash price and add a fee at the point of sale which is against the major card brands rules.

Yes, our team will complete your registration on your behalf. This typically takes 30 days to complete.

Yes, our team provides you with all necessary signage, keeping customers informed—and keeping you compliant.

It differs per merchant. The fee cannot be greater than your cost of accepting cards.

No, this solution automatically detects a debit card when entered and will not generate a credit card surcharge fee on the sale.

No, to pass on the credit card fee, merchants must comply with the contractual rules required by the card brands (such as Visa and MasterCard) as a condition of accepting their cards. Our Program is fully compliant!

Yes! Your customer can also always change his form of On-File payment at any time.

Your business can get fined a large sum of money from card brands for not being compliant with their Rules.